Transaction & Statement Automation for the Accounting Industry

Multiple Accounting Software Apps All Rolled Into One

Real Accounting Automation- Work Smarter With Ledgersync

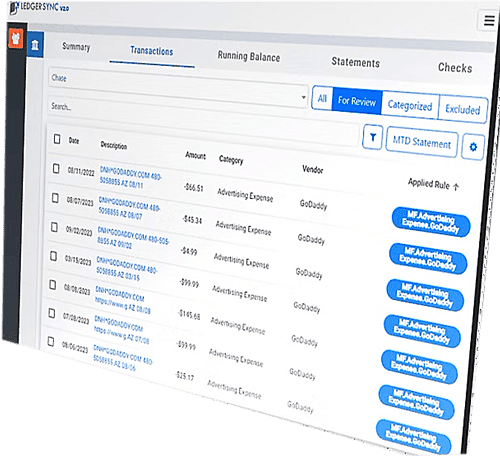

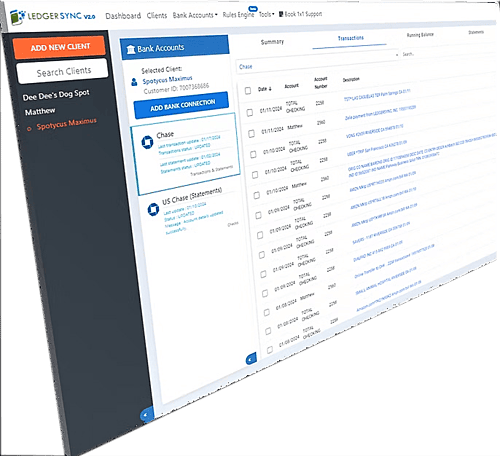

Imagine automating your bookkeeping by creating one set of rules across all your clients even if they have different Ledgers. The Ledgersync Rules Engine is hyper flexible allowing you to create rules that categorizes client transactions at company level or client level.

- Create Global Rules or Client Specific Rules Only Once.

- The Rules Apply To All Your Client Transactions Instantly

- Work Across All Your Clients By Date, By Description, By Vendor, By Category From One Web Page.

- Sync All Client Categorized Transactions Across All Your Clients To QBO

- The More Global Rules You Create The Less Work You Have.

Why LEDGERSYNC!!

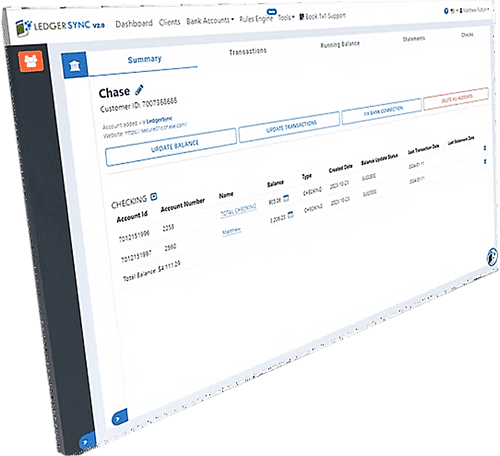

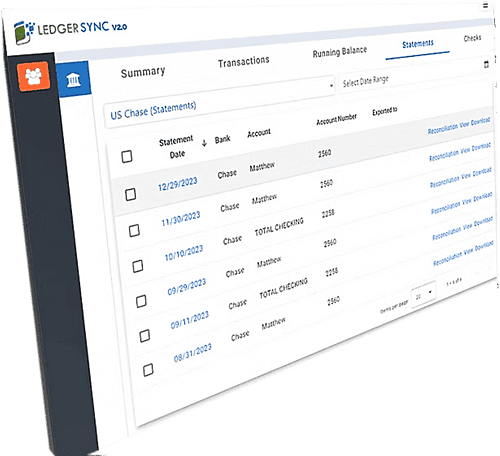

One Place for All Your Client's Financial Data

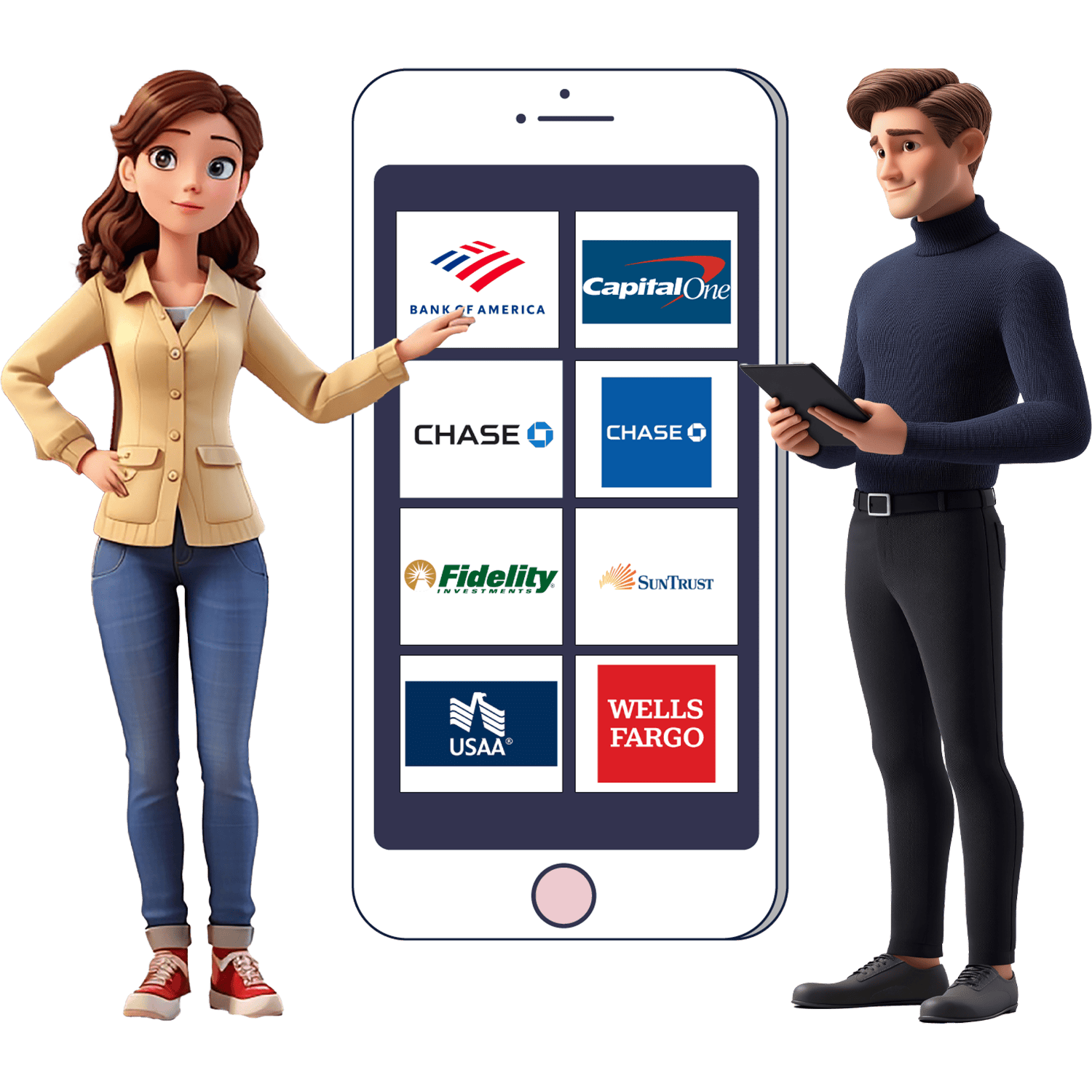

Connect with more than 10000 Financial Institutions

Ledgersync has entered into a strategic partnership with Mastercard, a move that significantly enhances the platform’s ability to provide seamless access to a larger number of financial institutions than any other accounting platform currently available in the market.

This partnership not only strengthens Ledgersync's offering but also empowers users with access to an extensive range of financial institutions and services, making it easier for businesses and individuals alike to manage their accounting and financial data in one unified platform.

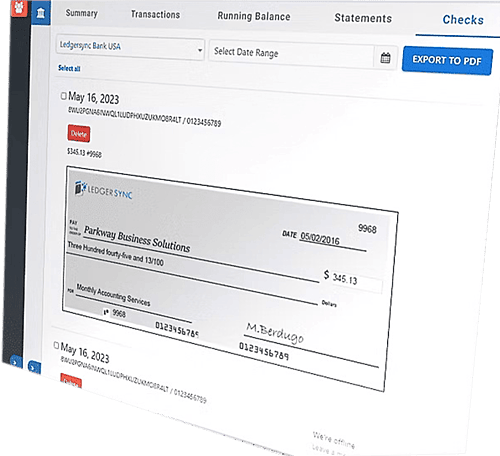

Ledgersync Features

Ledgersync is Platform Agnostic

Ledgersync allows you to download your transactions in the most commonly used file types. This allows us to work with multiple accounting platforms and cloud storage applications.